CN Capital Group operates as a client advisor advocate with an established nationwide capital provider network.

The CN Capital Group team understands the nuances of each capital provider’s internal underwriting, approval, and closing process. That knowledge allows our team to know exactly when to nudge things along to ensure all parties maintain a consistent “sense of urgency” on behalf of our clients.

CN Capital Group lends a solid reputation and credibility to ensure warm introductions of our clients to our established national capital provider network.

Loan Types & Advisory Services

Permanent Mortgages

Short and long term debt related to all asset types.

Construction Financing

AD&C, ground-up, repurpose & redevelopment related to all asset types.

Acquisition

Bridge

Short-term fixed or floating rate for transitional properties.

Land/Pre-Development Loans

Short-term, floating-rate loans to facilitate land acquisition and/or pre-development and entitlement processes.

Credit Lease Financing

Fixed rate, short and long-term debt for properties with credit or investment grade tenants.

Mezzanine

Capital

Enable a Sponsor to achieve desired leverage point at a competitive cost of capital.

Joint Venture Equity

Equity introduction for acquisition and development of all property types.

Advisory Services

CRE review, structuring, negotiation and placement of funding requests related to acquiring, financing/refinancing, selling or 1031 exchange of CRE assets.

This is a summary representation of the products and services offered by CN Capital Group, LLC. For a complete listing of the funding categories, asset types, and services offered by our firm, click here.

Fairway has spent the decade since the Great Recession building a unique business model designed to efficiently deploy large amounts of investment capital into the vast $8 trillion* U.S. middle market space.

We target a full range of real estate asset strategies and property types, assessing each potential operating partner and each opportunity carefully with extensive due diligence and a deeply ingrained value-investing mindset.

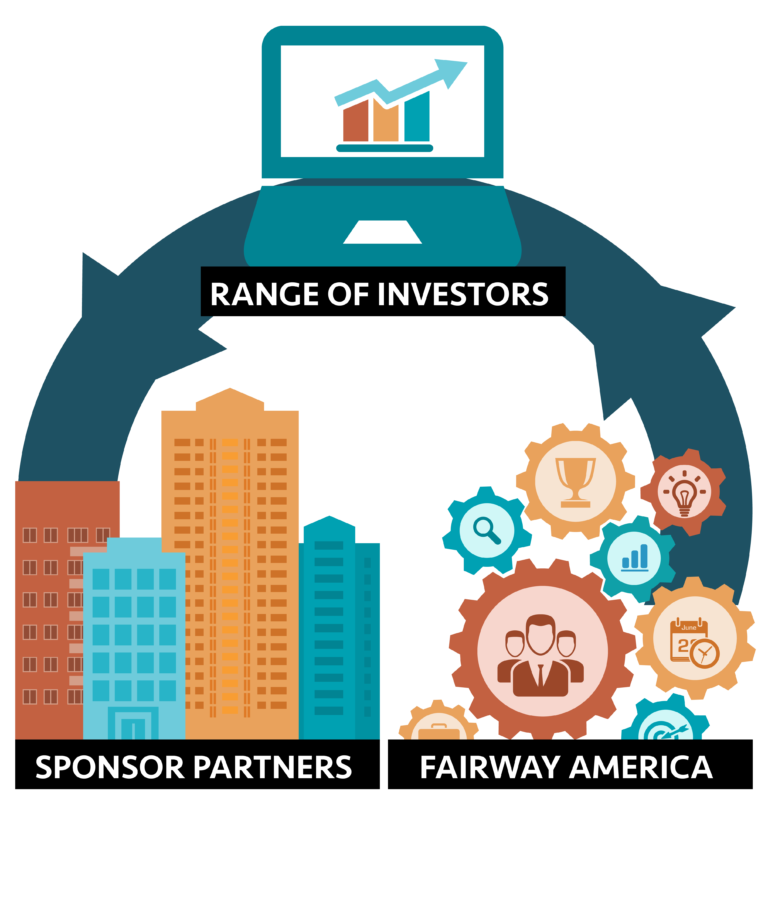

Fairway has crafted an innovative, specialty real estate ecosystem capable of generating alpha for investors.

Our two-sided platform – benefiting a full range of real estate sponsors and investors – has created a value proposition distinctive in the middle market space.

Fairway has spent the decade since the Great Recession building a unique business model designed to efficiently deploy large amounts of investment capital into the vast $8 trillion* U.S. middle market space.

We target a full range of real estate asset strategies and property types, assessing each potential operating partner and each opportunity carefully with extensive due diligence and a deeply ingrained value-investing mindset.

FAIRWAY’S CORE VALUES

Act with Integrity • Focus on What Matters • Get It Done, Do It Right

Learn, Grow, Adapt, Improve • Value for Value

Our values are not just empty words – they have been carefully considered, discussed, and honed over more than 20 years. We live and breathe them every day while pursuing our company’s mission of facilitating a massive flow of capital to the middle market space.

From understanding and addressing the key pain points of our operating partners to enabling investors to make more informed and less emotional decisions, we always strive to do what is right and to provide value to all our stakeholders – sponsors, investors, employees and shareholders.

Matt Burk & The Fairway America Team

*Source: Nareit Research, July 2019 “Estimating the Size of the Commercial Real Estate Market”

Contact Us

To learn how Fairway America may benefit your investment portfolio contact us at 503-906-9100 or email with any questions you have.